The blurring lines between software and service

There was a time when the distinction between software and services was clean-cut. A software company built tools and a service company delivered outcomes. The former lived on gross margins and the latter scaled with headcount. And venture capital, predictably, sided with software in its search of power law driven outcomes.

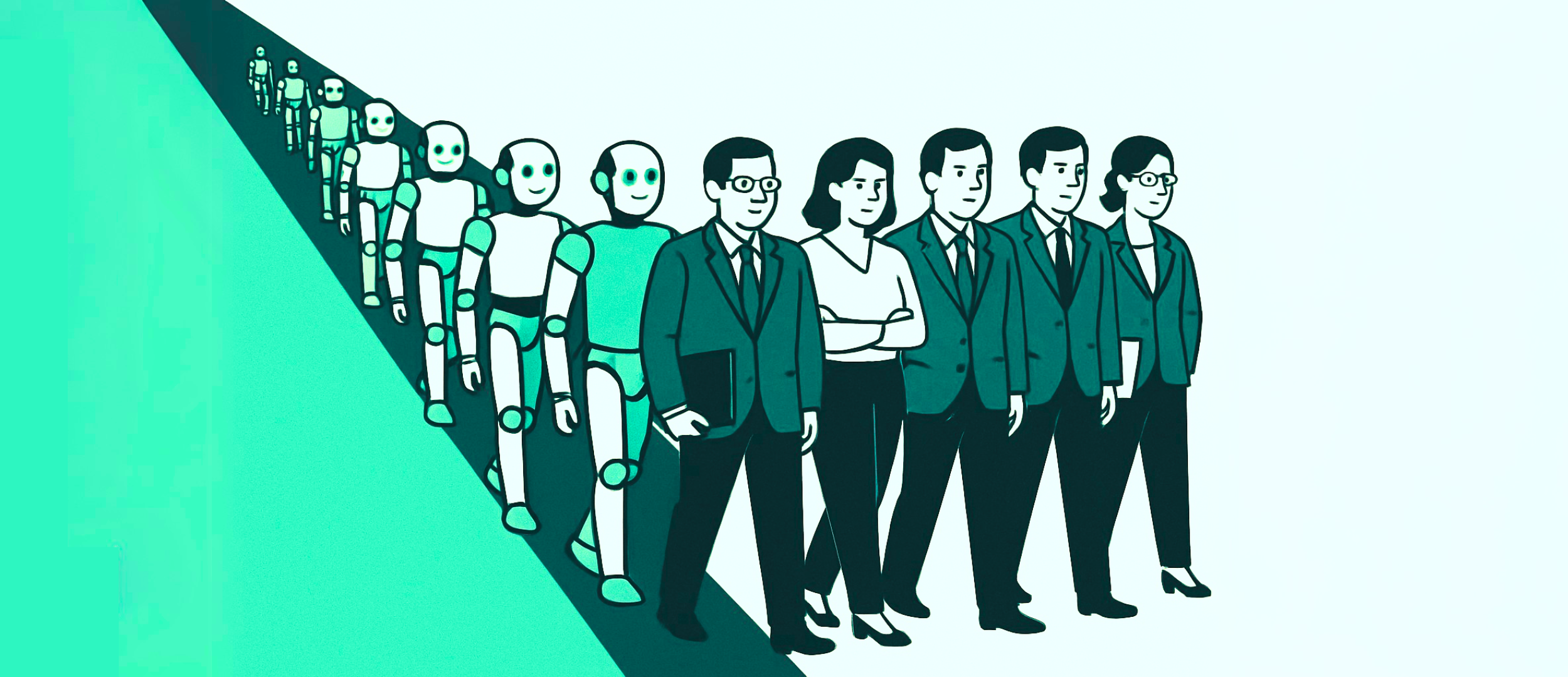

But that line (between product and people, code and consultants) is being pushed toward a blurry middle from both ends.

The productization of service providers

For much of the past few decades, the path to software-like economics required building actual software products. Agencies and consultancies, while occasionally tech-enabled, were still fundamentally human-driven operations. But something has shifted. AI is enabling a new kind of service model - one that starts out looking like an agency but quietly morphs into a product company under the hood.

We are beginning to see this in sectors where complexity, trust, and context are high, and where historically it was assumed that only humans could deliver the value: think of accounting, compliance, legal ops, executive assistance. These are not the traditional hunting grounds for software companies given complex unit economics and GTM motions. But as AI systems become better at mimicking expert workflows, service providers are increasingly layering software into their operations.

Some of these companies begin as classic agencies (e.g.: a boutique tax advisor or a hands-on back-office compliance partner) solving problems manually, one client at a time. But as they identify repeatable patterns and build automation around them, they begin to swap human labor for scalable logic. Reports start to write themselves. Compliance checks happen programmatically. Client onboarding is increasingly self-serve. Over time, the delivery engine becomes less about human expertise and more about trained models and internal tools.

From the outside, they still position themselves as agencies. Their websites still focus on “trusted partnerships” and “hands-on service”. Their GTM motions lean heavily on credibility, trust-building, and the promise of tailored solutions. And that is no accident. For end users navigating mission-critical problems, service remains a more familiar and trustworthy promise than software.

But peel back the curtain, and you will often find a software core powering the entire experience - a product company in disguise, using the service façade to gain market access, learn from clients and productize what once required human labor.

The rise of the Palantir-style product company

At the same time, product companies are getting their hands dirty.

AI startups, in particular, are realizing that building great software is not enough. The real challenge is making sure it works in the wild - across messy processes, incomplete data, and unpredictable human workflows. The last mile (especially in enterprise) is rarely solved with code alone.

So they are “doing things that do not scale”: embedding deeply with customers, offering hands-on implementation, customizing workflows, tuning models, and staying close long after the sale closes. And they are building an army of forward-deployed engineers who look a lot like internal consultants to make it happen.

Palantir was one of the earliest and most extreme examples of this model. Their forward-deployed engineers lived alongside clients four to five days a week, solved real problems on-site, and then abstracted the solution into a product others could use.

Today, we are seeing this model replicated across the board. From OpenAI to early-stage SaaS startups, forward-deployment is becoming the new standard for capturing value in complex environments. These teams act as the connective tissue between a general-purpose technology and a domain-specific application.

In a world where many AI products still rely on human-in-the-loop supervision, where trust and explainability matter, and where business logic lives in messy, undocumented processes, services are not a crutch. They are a wedge and a moat.

This shift in delivery has also triggered a shift in pricing as we previously discussed here. As software companies begin to embed deeper into customer workflows, they are moving away from seat-based pricing (charging for access to a product) and toward outcome-based models that tie revenue to results. When software becomes the service, the value equation naturally changes and pricing starts to reflect output.

So, from the other side of the table we are witnessing a shift in what it means to be a product company. Software companies are beginning to act more like next-gen consultancies.

VC is recalibrating accordingly

Naturally, these shifts are starting to ripple into the world of venture capital, which has historically drawn a hard line: software scales and services do not.

But as that premise frays, so do the boundaries of what gets funded and why.

We are seeing a growing number of software-first companies raise capital while running surprisingly labor-intensive operations. They embrace service-like motions for faster iteration, stronger retention, and deeper defensibility. Lower gross margins are not a dealbreaker if the service layer builds trust, unlocks value, or serves as a bridge to automation.

This also raises a new set of questions for venture investors - Can these service-heavy models scale in a way that still delivers venture outcomes? Will building category-defining champions in these spaces require more consolidation, M&A, or vertically integrated plays? What happens to traditional notions of defensibility, margin expansion, and exit pathways when the line between product and service disappears?

The thesis is evolving, but the jury is still out.

***

Services are getting automated and software is getting humanized. And the sharp distinctions that used to define business models - product vs. project, margin vs. manpower, scalable vs. linear - are dissolving.

The real question is no longer what to build but how to deliver it. And increasingly, the answer lives somewhere in between.

See also

More insights to better the world through technology

.png)